Connecting with your bank online has become a big part of how many people manage their money these days, basically. It's about being able to handle your financial matters from wherever you happen to be, whether that's your living room couch or a coffee shop across town. This shift means banks are finding new ways to reach out and help their customers, bringing services right to your fingertips.

You know, for a long time, banking meant going into a building, waiting in line, and talking to someone face-to-face. While that personal touch is still very important for many, the digital age has added layers of convenience that were once just a dream. Now, you can do so much without ever stepping outside, which is really quite something when you think about it.

So, it's almost natural that places like banks are starting to think about how they show up in other digital spaces, like on social platforms. It's not just about having a website anymore; it's about being where people are, ready to help or share information. This kind of digital presence, in a way, helps bridge the gap between traditional services and the immediate needs of today's busy individuals, making everything feel a little closer.

- Tyrese Haliburton Mother

- Alex Morgan Daughter Charlie

- Who Was Saved In The Voice

- Daniel Smith Wife

- How Old Is Jodie Sweetin Husband

Table of Contents

What Kinds of Services Can a Bank Offer You?

How Does Connecting Online Make Things Easier?

- Did Shaq Have A Stroke

- Ellen Degeneres Lives Where

- Glorilla Husband

- Cobra Kai Actors That Died

- Florida Teens

How Can Digital Tools Really Help Your Money?

Keeping Things Safe with Digital Bank Connections

Are Online Accounts a Good Fit for Everyone?

The Community Spirit in Modern Banking

What Kinds of Services Can a Bank Offer You?

When you think about a bank, what comes to mind first? For many, it's a place to keep their money safe, and that's definitely a big part of it. But banks, like South Indian Bank, actually offer many different ways they can help you with your money matters. They have ways to borrow money, for instance, like personal loans or bigger sums for homes. They also provide ways to protect what you have, through things like different kinds of protective plans for your life or your belongings. It's quite a lot, you know, more or less covering a lot of what people need in their financial lives.

Then there are the common things, like plastic for purchases, which let you spend money without carrying cash around. And, of course, places to keep your money safe, like regular savings accounts where your funds can grow a little over time. They also offer longer-term savings plans, where you set aside money for a specific period, often getting a bit more in return. For those who want to pool their money with others for potential growth, there are group investments too. And if you need to send money to others, perhaps family or friends, they have services for that as well. All these things are put together to fit what you need for yourself, making sure you have options for almost any money situation, which is pretty useful.

How Does Connecting Online Make Things Easier?

One of the really helpful things about modern banking is the ability to do so much from your own home, or really, anywhere you have an internet connection. Take South Indian Bank's online system, which they call 'sibernet'. It's basically their way of letting people who bank with them get what the bank offers using the internet. This means you can do bank stuff from your home, which is a huge convenience for many people. It means fewer trips to a physical spot and more time for other things, which is just a little bit better for everyone's busy schedules.

When you get into your bank's online system, it helps you watch your money from home, keeping tabs on what's going in and out of your accounts. But it also lets you see and stop anything that looks like someone trying to trick you, pretty fast. This is a very important part of staying safe with your money in the digital world. The bank teaches computer programs using what people who know a lot have learned, to make special ways to look at how you spend money. This kind of tool can give you a clearer picture of where your money goes, helping you make better choices, which is actually quite helpful for managing your finances.

Finding Your Local Bank Spot

Even with all the digital convenience, sometimes you just need to visit a physical bank location. Maybe you have a question that's easier to talk about in person, or you need to handle something that requires a face-to-face chat. Luckily, banks understand this, and they make it pretty simple to figure out where a local bank spot is close to you. You can use their tool that shows where its places are, which is typically found on their website. This means you don't have to guess or drive around looking for one, which is kind of nice.

This tool also lets you see the names of all the places where the bank has its spots, which states they are in, and so on. So, if you're traveling or just want to know if there's a branch in a particular area, you can easily look it up. It’s about making sure that even though much of banking can happen online, you still have that option for in-person support whenever you might need it. This dual approach, combining digital convenience with physical presence, offers a pretty complete picture of how a bank serves its customers, you know.

How Can Digital Tools Really Help Your Money?

Beyond just checking your balance or moving money around, digital tools from your bank can actually give you a much better handle on your finances. They offer different kinds of accounts and places to put your money. You can look at all these different options and pick from accounts where your money can grow, like regular savings. Or, you might prefer ones where you put it away for a set time, which are often called term deposits. These choices are all there to help you get what your money situation needs, whether you're saving for something big or just building up a rainy day fund. It’s about finding the right fit for your personal goals, which is definitely something worth considering.

These online platforms also often come with features that help you keep track of your spending habits. Remember those special ways to look at how you spend money? They can show you where your money is going each month, categorized into things like food, entertainment, or bills. This kind of insight can be really eye-opening, allowing you to spot areas where you might be able to save a little extra cash. It’s like having a personal money coach, sort of, helping you make smarter choices without having to do all the calculations yourself, which is quite handy for many people.

Keeping Things Safe with Digital Bank Connections

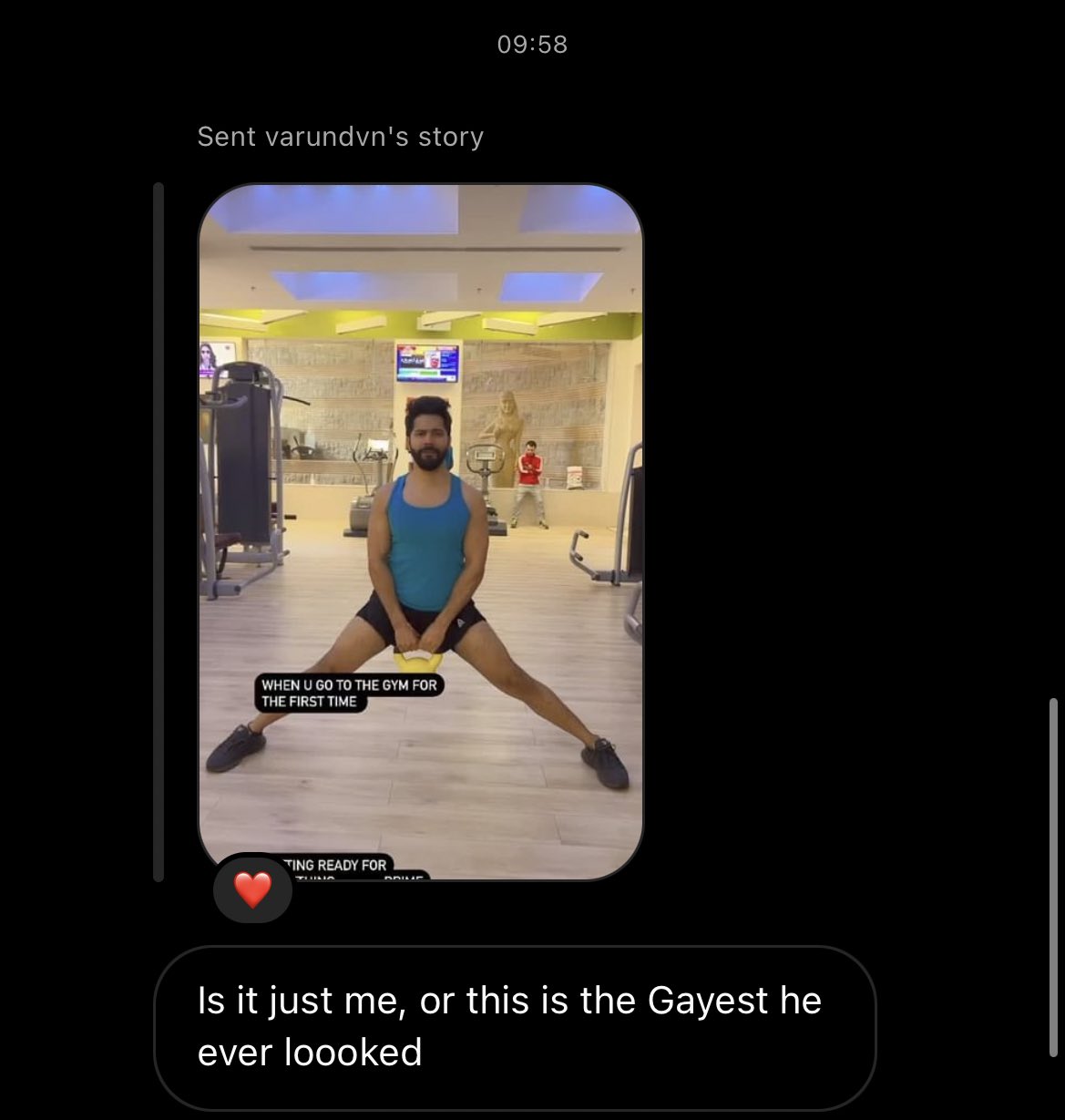

When we talk about banks being present in digital spaces, like the idea of a "sib twitter" connection, safety is always a top concern. It's about making sure that while you're getting convenience, you're also staying protected. Banks put a lot of effort into making their online systems secure, using good ways of doing things for online safety. This means that when you're interacting with your bank, whether it's through their official website or perhaps a verified social media presence, they're working to keep your information private and your money safe. It’s pretty important to remember this, actually.

For instance, the bank's online system, 'sibernet', is set up to help you keep track of your accounts online. This isn't just about convenience; it’s also a key way to spot anything out of the ordinary. If you see something that doesn't look right, you can address it quickly. So, when thinking about a bank's presence on platforms like Twitter, it's less about sharing personal details there and more about general information, support, or perhaps alerts. It’s about creating another avenue for communication that respects your privacy and security, which is absolutely vital in today's connected world. They want to make sure you feel good about using their services, no matter the platform.

Are Online Accounts a Good Fit for Everyone?

The question of whether online accounts and digital banking are suitable for everyone is a good one to think about. For many, the ability to manage their money from home or on the go is a huge benefit. It saves time and offers a lot of flexibility, especially for people with busy schedules or those who live far from a physical bank location. You can do almost everything you need to do, from checking balances to paying bills, with just a few clicks. This level of access, honestly, has changed how a lot of people approach their finances, making it much more accessible.

However, some people might prefer the traditional way of doing things, liking the personal interaction that comes with visiting a bank in person. They might feel more comfortable discussing their money matters face-to-face, or they might not have easy access to the internet or the necessary devices. Banks, including South Indian Bank, tend to offer a mix of both. They take on the very good old ways of local banking to give you all sorts of different accounts, ways to borrow money, and help with your finances, while also providing those digital options. This means you can choose the way that feels best for you, which is really what good service is about, at the end of the day.

The Community Spirit in Modern Banking

Even as banking moves more into the digital space, the core idea of community banking remains strong. This means a bank aims to be a helpful part of the local area, offering support and services that truly matter to the people who live there. South Indian Bank, for example, has taken on the very good old ways of local banking. They promise to give each of their services with a very good standard, making sure that whether you're dealing with them in person or online, you feel valued and supported. It’s about building trust and being a reliable partner for your money matters, which is pretty important.

This community spirit extends to how banks think about their digital presence. It’s not just about pushing out information; it’s about being available to help and to listen. A bank’s presence on a platform, like the idea of a "sib twitter" connection, could be a way to quickly share updates, answer common questions, or point people to the right resources. It's another way to maintain that connection, making sure that even as technology advances, the human element of banking—the part that cares about your financial well-being—stays at the forefront. It’s about blending the old ways with the new, for sure.

- Claire Dutton In 1883

- Buffalo Wild Wings Allyou Can Eat

- Do Meredith And Thorpe Get Married

- Waffler Dead

- River Robertson Now